Coworking trends in the year 2020

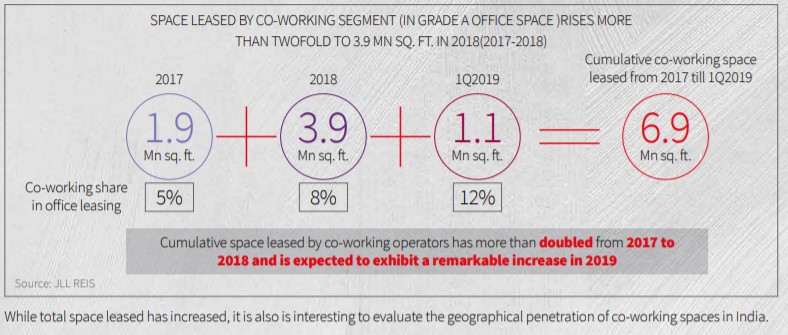

- The total area occupied by co-working spaces in 2018 was 7-7.5 million sq.ft. which increased to 12 million sq. ft. in 2019.

- With the help of investors and PE funds, the big players are likely to join the league in 2020.

- Good merger and acquisitions have been forecasted in the year 2020-The no. of co-working centers is expected to double in the coming years.

- In 2020, coworking operators are projected to become the next heavily influenced industry by blockchain.-Eco-friendly infrastructure is something that will trend in 2020.

Let’s take a look at what’s in the store for coworking trends in the year 2020 and identify what are the key factors-

It is said that the workplaces are planned with the interconnected environment for technology by 2020. Millennials are always in search of high-quality, high-speed, affordable, and covetable space and services, innovative technology is in demand to meet these needs of today’s generation.

The large coworking players to expand in 2,3 tier cities-

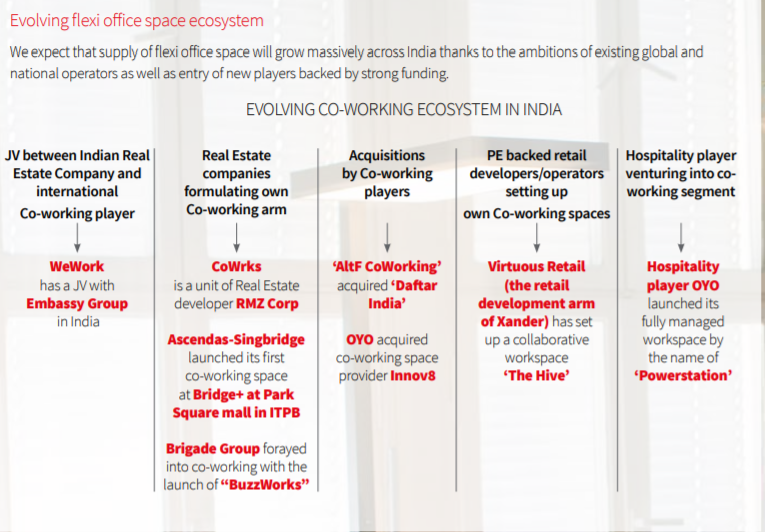

Populated by various players, India is the country to witness an increasing number of shared workspaces. These players include We Work, Cowrks, Awfis, Oyo Workspaces, Springboard, Smartworks, etc. Today, these players have their centers across 350 cities in India, which is likely to double/treble in the coming years. Thus, this will be an upward trajectory. For multiple reasons, MNCs and established companies are also tilting towards coworking spaces in tier 2 & tier 3 cities.

Funding by various institutions increasing rapidly-

Being fundamentally capital intensive, the funding for coworking spaces has gradually increased in these years and is forecasted to grow. The year 2017 witnessed angel investors & very few PE Players, while 2018 & 2019 saw maximum deals driven by large PE players which gained a strong confidence in India’s co-working story. Thus, with the aid of investors and PE funding, the big players are likely to be bagged in the year 2020 which will allow them to expand more offices.

Strengthening of Coworking:

There are around 350 coworking companies in India as of today, but not all of them may survive the long haul. With too many players in one market, a saturation point is bound to be reached, beyond which the larger companies will take over the smaller ones. Mergers and acquisitions are an inevitable and fast-approaching trend to look out for in the coworking space. Dominant market players will acquire the smaller organizations, leading to only a few top-notch players in the market in the coming year. Like OYO taking over Innova8 for INR 220 Cr in 2020, we will see smaller or city-specific operators in 2020.

Eco-friendly and climate-conscious initiatives:

Environmental concerns have increased due to drastic climate change across the planet. India is home to some of the hottest cities in 2019, and other issues like water crises of different kinds across the nation are some examples of why immediate action is required. Coworking spaces in India already boast some eco-friendly initiatives which all their clients must participate in. An activity that could also serve as a CSR initiative for companies, activities, and initiatives, or even an eco-friendly infrastructure, are some trends that could emerge in the coming year for coworking spaces.

Budding businesses will drive co-working demand

The burgeoning and prominent segment of millennials is set to form almost 50% of the global workforce of 2020. According to JLL’s ‘Co-Working report on Reshaping Indian Workplaces’. India is known as the second-largest market for the coworking industry after China. India is known for being the youngest startup nation in the world after the US & UK.Bengaluru, Pune, Hyderabad, Gurugram, etc. are the few cities that have experienced the rise of the entrepreneurial wave. SMEs and large enterprises are also following suit, allowing their employees to be versatile and have effective time management.